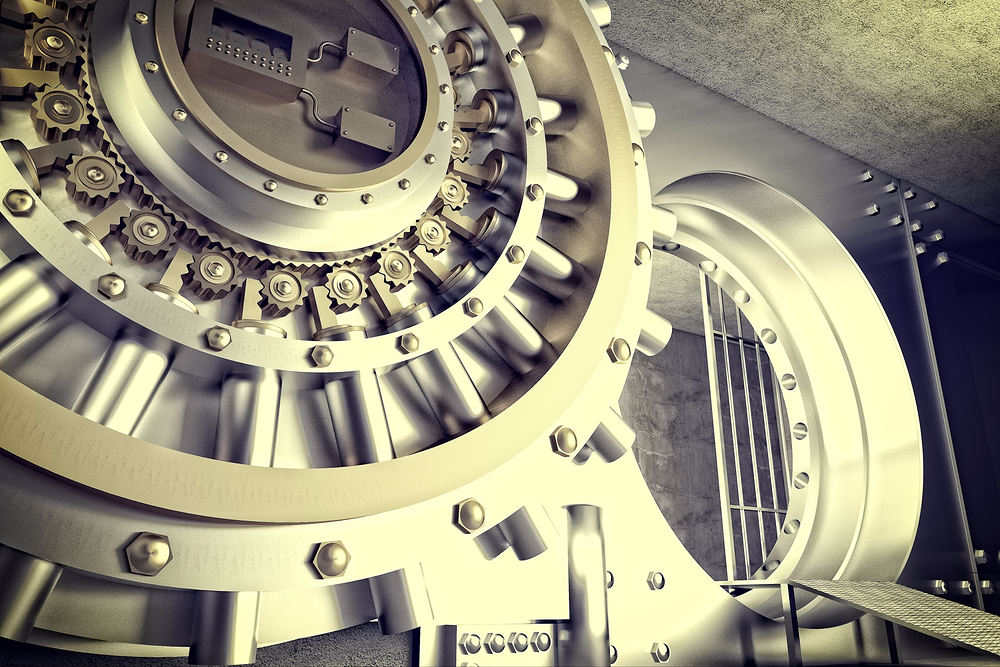

Chinese Bank Buys “Secret” London Gold Vault

In another indication of Chinese demand for physical gold, China’s ICBC Standard Bank has reportedly agreed to buy a London vault from Barclays. The ICBC Standard Bank is the largest bank in the world by assets, and the vault being purchased is one of the largest in all of Europe. While the exact whereabouts of the vault are unknown, it reportedly is within the M25 road and can allegedly hold up to 2000 metric tons of gold and other precious metals. Mark Buncombe, head of commodities... Continue Reading

Category | Economic and Geopolitical News