Putting U.S. Debt into Perspective

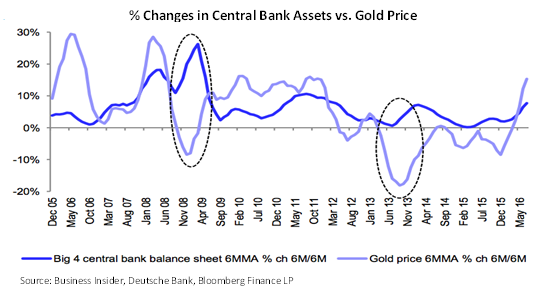

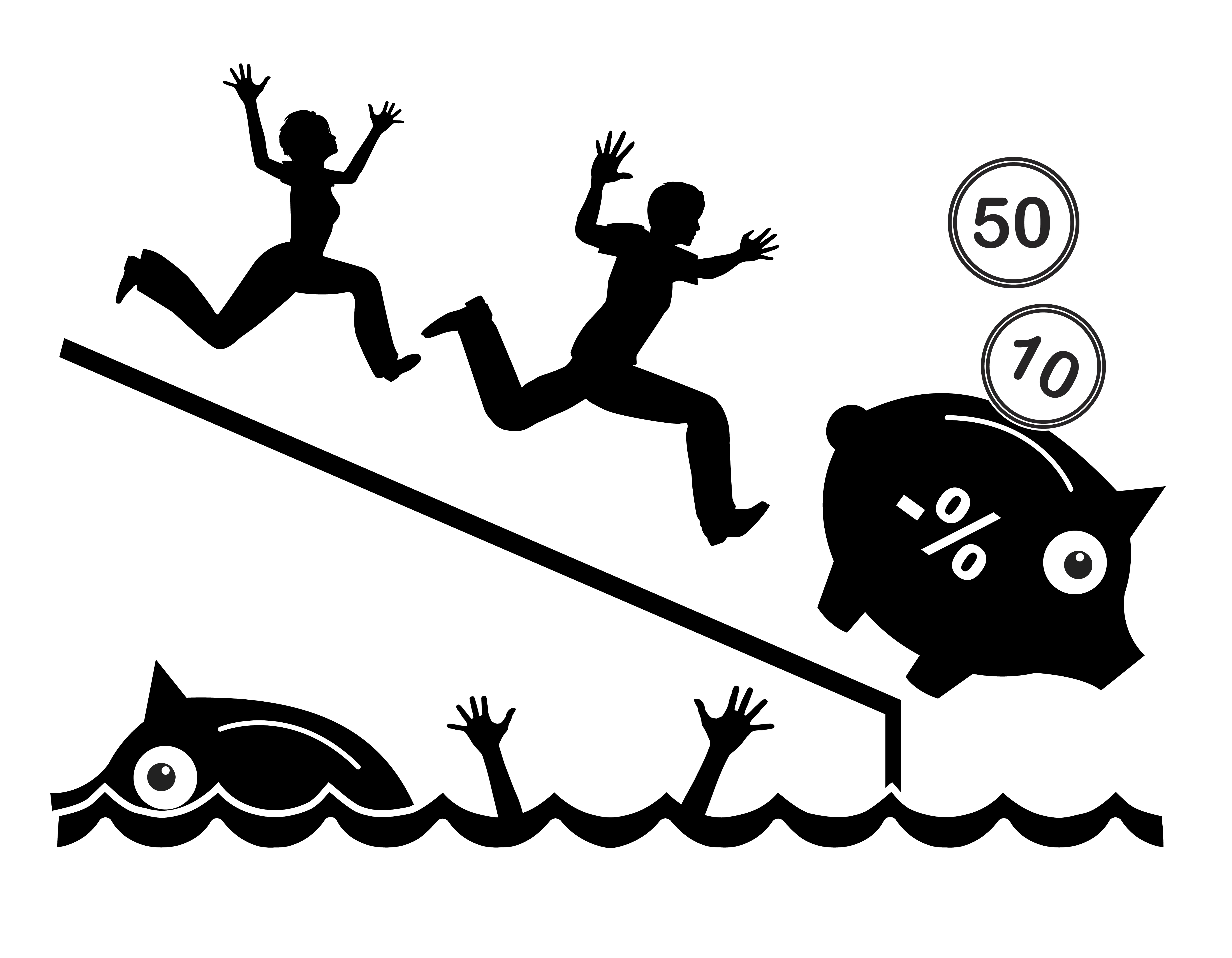

The issue of debt is often discussed in the same context as physical gold, and with good reason in our opinion. While the U.S. debt situation comes up now and again among investors, it is amazing how the issue is most often simply swept under the rug. It seems that the only time it really becomes a concern with the public is when the government is facing a possible shutdown over budgetary disagreements. Debt is one of those types of problems, however, that will not... Continue Reading

Category | Economic and Geopolitical News